Diabetic Retinopathy Market Size Worth USD 17.91 Billion by 2034

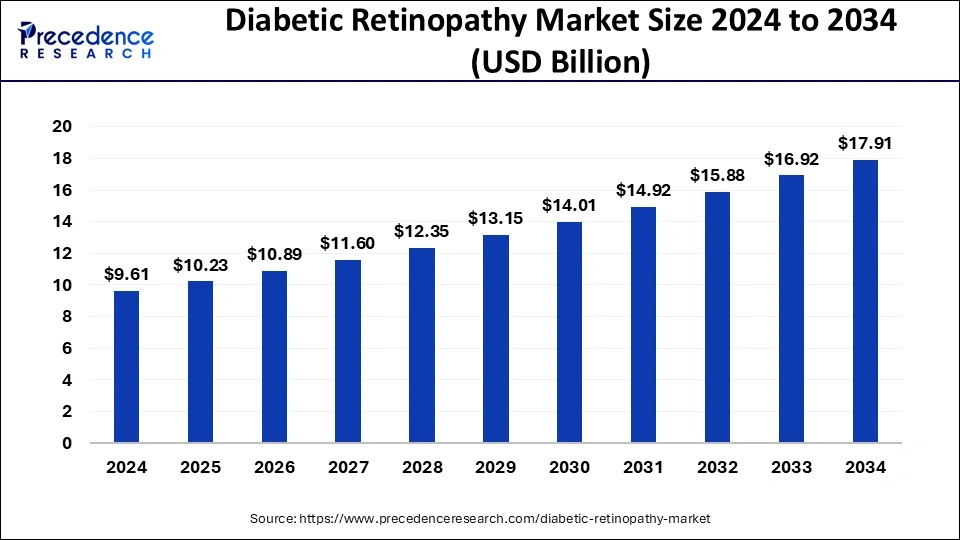

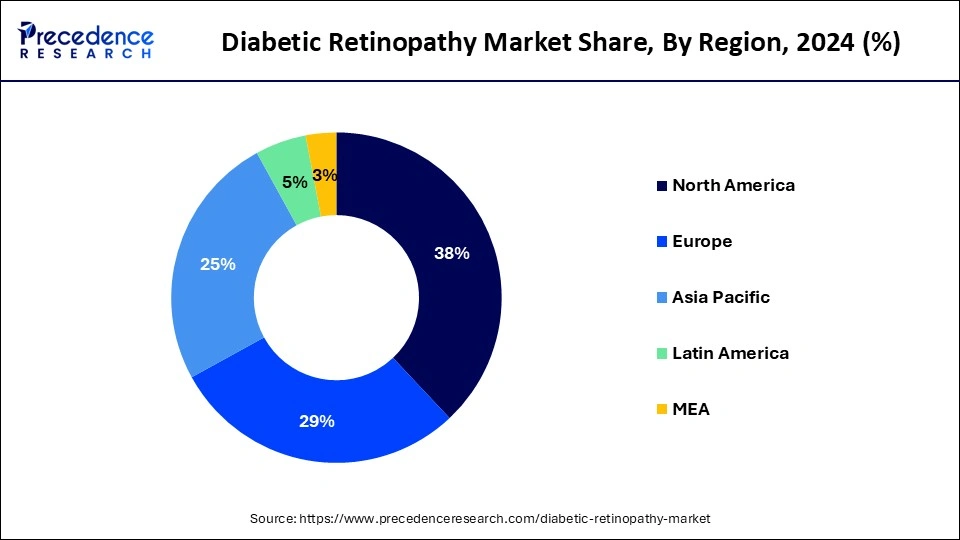

According to Precedence Research, the global diabetic retinopathy market size will grow from USD 10.23 billion in 2025 to nearly USD 17.91 billion by 2034, with an expected CAGR of 6.42% from 2025 to 2034. North America dominated the market with a 38% share in 2024, while Asia Pacific is projected to witness significant growth during the forecast period.

Ottawa, Oct. 30, 2025 (GLOBE NEWSWIRE) -- The global diabetic retinopathy market size is expected to be worth over USD 17.91 billion by 2034, increasing from USD 10.89 billion in 2026, growing at a strong CAGR of 6.42% between 2025 and 2034. The growing senior population, increasing prevalence of diabetes under developed economies, and suitable reimbursement available for ophthalmologic surgeries in developed as well as developing economies are driving the growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3954

Diabetic Retinopathy Market Highlights:

- In terms of revenue, the global diabetic retinopathy market was valued at USD 9,610 million in 2024.

- It is projected to cross more than USD 17.91 billion by 2034.

- North America accounted for the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the market from 2025 to 2034.

- By type, the proliferative diabetic retinopathy segment held the major market share in 2024.

- By type, the non-proliferative diabetic retinopathy segment is growing at a solid CAGR from 2025 to 2034.

- By age group, the 40-49 age group segment contributed the biggest market share in 2024.

- By age group, the 65-74 age group segment is expanding at a strong CAGR from 2025 to 2034.

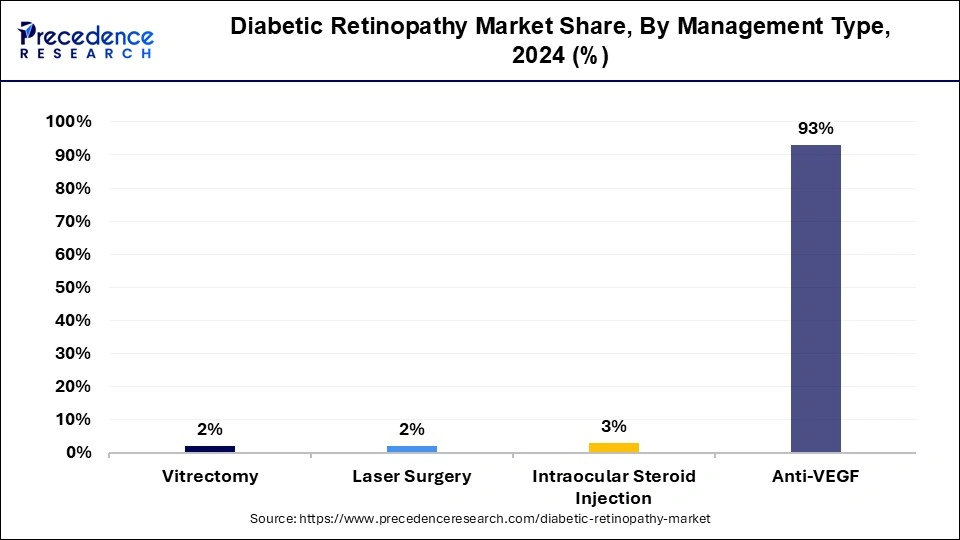

- By management, the Anti-VEGF segment dominated the market in 2024.

- By management, the vitrectomy segment is poised to grow at a notable CAGR from 2025 to 2034.

- By distribution channel, the hospitals and pharmacies segment accounted for the largest market share in 2024.

- By distribution channel, the ambulatory surgical centers segment is growing at a significant CAGR from 2025 to 2034.

What is the Diabetic Retinopathy?

The diabetic retinopathy market refers to the production, distribution, and use of diabetic retinopathy which is a general term for all disorders of the retina caused by diabetes. Diabetic retinopathy is an eye condition that can cause vision loss and blindness in people who have diabetes. There are two main types of retinopathies proliferative and non-proliferative. Symptoms of diabetic retinopathy may include floating spots, changes in central vision, blurred vision, and even sudden vision loss.

The main treatments of diabetic retinopathy include laser treatments on the blood vessels at the back of the eye. Diabetic eye screening checks for signs of diabetic retinopathy, may before any changes in sight. Finding and treating early can prevent or reduce damage to eyes and sight loss. Diabetic retinopathy has a decremental impact on quality of life, which increases with severity in vision loss.

What are the Private Industry Investments in Diabetic Retinopathy?

-

Pharmaceutical Acquisitions: A major trend is the acquisition of smaller biotech firms with promising pipeline candidates by large pharmaceutical companies. For instance, Merck acquired EyeBio in May 2024 for a potential value of $3 billion, gaining EyeBio's late-stage candidate Restoret for diabetic macular edema and other retinal diseases.

-

Gene Therapy Development: Private investment is fueling the development of one-time gene therapies that offer a potentially permanent solution to diabetic retinopathy. An example is the significant investment in gene therapy company REGENXBIO, which is developing ABBV-RGX-314 for delivery via the suprachoroidal space.

-

Artificial Intelligence Diagnostics: Private capital is flowing into companies that are using AI to make diabetic retinopathy screening more efficient and accessible. Digital Diagnostics received a $75 million Series B funding round in 2022 to expand its autonomous AI-powered screening tool, IDx-DR.

-

AI-Enabled Handheld Cameras: Another area of investment is in advanced, portable AI-enabled cameras that can perform rapid and accurate diabetic retinopathy screening. For example, in May 2024, Optomed launched its Optomed Aurora AEYE, a handheld AI fundus camera, after gaining regulatory clearances for its technology.

-

Specialty Clinic Consolidation by Private Equity: Private equity firms are consolidating fragmented ophthalmology practices to build large networks for retinal care. This strategy allows them to capture a larger share of the anti-VEGF market and influence service delivery models, potentially increasing the use of certain high-cost treatments.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

What are the Key Trends of the Diabetic Retinopathy Market?

-

Growing prevalence of diabetes globally: The increasing number of people with diabetes worldwide, especially in emerging economies and aging populations, directly drives the growth of the diabetic retinopathy market.

-

Adoption of long-acting and gene therapies: To address the significant treatment burden and poor adherence associated with frequent intravitreal injections, longer-lasting anti-VEGF agents and one-time gene therapies are being developed and approved.

-

Integration of AI and telemedicine for screening: Artificial intelligence algorithms are being used to analyze retinal images for faster, more efficient, and automated detection of diabetic retinopathy, which, combined with telemedicine, improves access to care, particularly in underserved regions.

-

Shift toward personalized and combination therapies: New treatments target multiple disease pathways (beyond just VEGF), and researchers are exploring personalized and combination therapies that incorporate different agents and technologies for improved patient outcomes.

-

Growing focus on early detection and biomarkers: The market is emphasizing proactive, early intervention to prevent vision loss, which is driven by advancements in diagnostic imaging and the identification of new biomarkers for disease progression.

➤ Get the Full Report @ https://www.precedenceresearch.com/diabetic-retinopathy-market

Diabetic Retinopathy Market Opportunity

Integration of AI

Integration of artificial intelligence (AI) in diabetic retinopathy contribute to the growth of the market. Advantages of AI screening systems include convenience of point-of-care access and the potentially lower operating cost as a result of automatic interpretation of the images and referral to an eye care specialist only as needed.

AI algorithms that use CNNs are designed to automatically detect characteristic lesions, like retinal hemorrhages and microaneurysms, generally associated with DR. In addition, artificial intelligence (AI) holds the potential to predict diabetic retinopathy progression, improve personalized treatment strategies, and identify systematic disease biomarkers from ocular images through ‘oculomics’, moving towards a more accessible, precise, and efficient care.

Diabetic Retinopathy Market Challenges

Post-surgical Complications

Post surgical complications in diabetic retinopathy can limit the market. The irregular blood vessels that develop with diabetic retinopathy trigger the growth of scar tissue. This can pull the retina to pull away from the back of the eye. This may cause flashes of light, spots floating in our vision, severe vision loss or missing areas of vision.

Complications of diabetes after surgery include increase the risk of fluid and electrolyte imbalances, heart or lung issues, kidney problems, neurological complications, stroke or death. Post surgical complications include wound infections can spread to nearby tissue or organs, or to distant areas through the bloodstream, which when severe can cause death.

Diabetic Retinopathy Market Report Scope

| Report Attributes | Key Statistics | |

| Market Size in 2025 | USD 10.23 Billion | |

| Market Size in 2026 | USD 10.89 Billion | |

| Market Size by 2034 | USD 17.91 Billion | |

| CAGR 2025 to 2034 | 6.42% | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Key Growth Drivers | Rising diabetes prevalence, aging population, technological advancements in diagnostics and treatment, and increased awareness of early screening | |

| Segments Covered | Type, Age Group, Management, Distribution Channel, and Region | |

| Leading Segment (By Type) | Proliferative Diabetic Retinopathy (PDR) | |

| Leading Age Group (2024) | 40–49 Years | |

| Fastest-Growing Age Group | 65–74 Years | |

| Dominant Management Segment | Anti-VEGF Therapy | |

| Emerging Management Segment | Vitrectomy | |

| Dominant Distribution Channel | Hospitals & Pharmacies | |

| High-Growth Distribution Channel | Ambulatory Surgical Centers (ASCs) | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3954

Case Study: Kerala’s AI-Powered Revolution in Diabetic Retinopathy Screening

The state of Kerala, India, offers one of the most compelling real-world demonstrations of how artificial intelligence can transform diabetic retinopathy care at scale. In February 2025, the Government of Kerala, in partnership with Remidio, launched Nayanamritham 2.0 — the world’s first AI-driven government screening program for chronic eye diseases, including diabetic retinopathy.

The initiative integrated AI-based fundus imaging into the state’s existing primary healthcare infrastructure. Using portable, low-cost retinal cameras equipped with Remidio’s AI software, healthcare workers at community health centers could instantly analyze retinal images and identify patients at risk for diabetic retinopathy without needing an ophthalmologist on-site. The AI system automatically flagged referable cases for specialist review, significantly reducing diagnostic time and improving early detection rates, especially in rural and underserved regions.

This program marked a pivotal shift from reactive to proactive eye care, enabling mass screening of diabetic patients across Kerala. It showcased how AI-driven diagnostics can bridge healthcare accessibility gaps, lower operational costs, and empower frontline healthcare providers. Within months of deployment, the initiative screened thousands of individuals, many of whom were diagnosed in early, treatable stages—helping prevent irreversible vision loss.

The Kerala case exemplifies how public-sector adoption of AI technology can redefine preventive ophthalmology. It aligns perfectly with global diabetic retinopathy market trends—where governments, private firms, and technology developers are increasingly investing in AI-enabled, scalable, and cost-efficient screening systems to manage the rising burden of diabetic eye disease.

(Source: Government of Kerala and Remidio, February 2025)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Diabetic Retinopathy Market Regional Outlook:

North America led the market in 2024, with largest share of 38%, due to the supportive reimbursement policies, growing healthcare expenditure, developed healthcare systems, increased awareness, investment in gene therapy research, advanced surgical techniques, and increasing prevalence of diabetes in the region. Diabetes related eye disease is the number one cause of blindness for working age Americans.

The growing prevalence of diabetes and the elderly population growth, fueling the innovations and adoptions of cutting-edge diabetic retinopathy. Additionally, a strong focus on advancements in AI-powered diagnostics, tele-ophthalmology, and demand for minimally invasive surgical techniques is solidifying the regional position in the global market.

- According to American Diabetes Association, in 2021, 38.4 million Americans, or 11.6 % of the population, had diabetes. Of the 38.4 million adults with diabetes, 29.7 million were diagnosed, and 8.7 million were diagnosed. (Source: https://diabetes.org/about-diabetes/statistics/about-diabetes#)

What is the U.S. Diabetic Retinopathy Market Size?

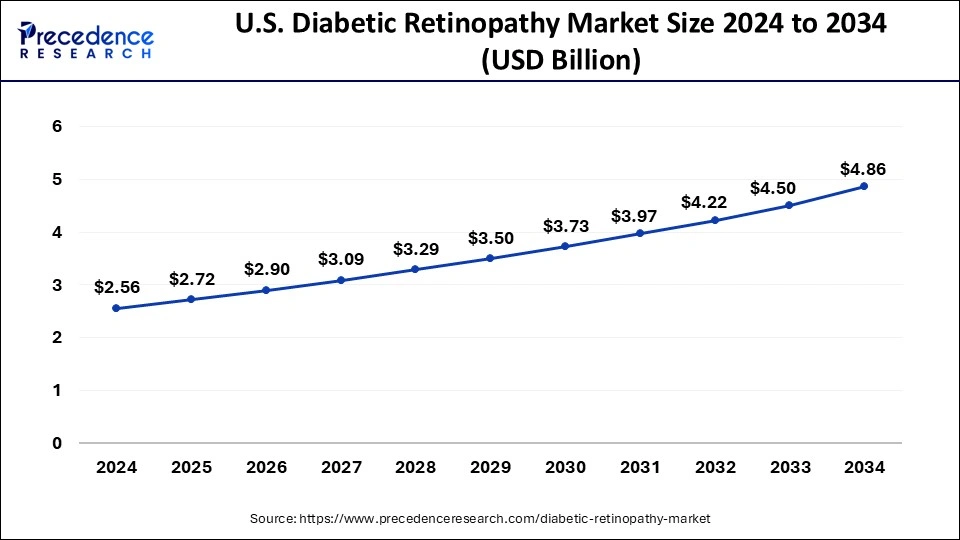

According to Precedence Research, the U.S. diabetic retinopathy market size is calculated at USD 2.72 billion in 2025 and is anticipated to reach over USD 4.86 billion by 2034, with a strong CAGR of 6.62%.

The U.S. Diabetic Retinopathy Market Trends

The U.S. dominates the regional market due to its large diabetic population, advanced healthcare infrastructure, and widespread access to diagnostic and treatment technologies. The country has a high prevalence of both type 1 and type 2 diabetes, particularly among aging and at-risk populations, leading to a significant burden of diabetic eye diseases.

Additionally, strong government and private sector investment in healthcare, robust reimbursement systems, and the presence of key market players and research institutions foster innovation and adoption of advanced diagnostic tools like OCT and AI-based screening.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/3954

Asia Pacific is expected to witness significant growth in the market during the forecast period because of the research and development, focus on early-stage treatment, growing healthcare expenditure, technological innovations, innovations in treatment, increased awareness, and rising prevalence of diabetes in the region. Within India, the prevalence of diabetic retinopathy (DR) varies dramatically, ranging from 4.3% to 27.3% across different states.

The rising adoption of novel diagnostic and therapeutic technologies is fueling growth in countries like China and India. The strong focus on advanced treatments like anti-VEGF, innovative diagnostics like OCTA, and intraocular steroidal injections contributes to market growth.

India Diabetic Retinopathy Market Analysis

India is emerging as the dominant country in the regional market due to its rapidly growing diabetic population, increasing awareness of diabetic complications, and expanding healthcare infrastructure. With one of the highest numbers of people living with diabetes globally, India faces a significant burden of diabetic retinopathy, especially as early screening and diagnosis become more accessible through government initiatives and private sector involvement.

The country's focus on improving ophthalmic care, growing adoption of telemedicine and AI-based retinal screening, and the presence of cost-effective treatment options further contribute to its leadership in the regional market.

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Diabetic Retinopathy Market Segmentation Insights:

Type Insights

Which Type Dominates the Diabetic Retinopathy Market?

The proliferative diabetic retinopathy segment dominated in the market in 2024. There is difficulty in treating diabetic retinopathy. But treatment works very well to prevent, delay or reduce vision loss. The sooner the condition is found, the easier it is to treat. Proliferative diabetic retinopathy (PDR) is the more advanced stage of diabetic eye disease. It happens when the retina starts growing new blood vessels. This is called neovascularization. These fragile new vessels may bleed into the vitreous.

The non-proliferative diabetic retinopathy segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The main features of non-proliferative diabetic retinopathy include cotton wool spots, intraretinal hemorrhages, microaneurysm, and hard exudates. It also include venous tortuosity or beading, capillary dropout and intraretinal microvascular abnormalities (IRMA). NPDR management typically involves less invasive and more cost-effective interventions, such as anti-VEGF therapies and monitoring, making it more accessible and widely adopted.

Age Group Insights

Which Age Group Leads the Diabetic Retinopathy Market?

The 40-49 age group segment led the market in 2024. Near about 4.1 million US adults 40 years and older have diabetic retinopathy. Patients with diabetes onset before 40 years had a 5.56 times higher risk of developing DR compared to those diagnosed at 60 years or older. Undiagnosed diabetes was most popular in those aged 40 to 49 years compared to the other age group. Additionally, rising rates of obesity, sedentary lifestyles, and early-onset diabetes contribute to increased prevalence in this group.

The 65-74 age group segment is projected to experience the highest growth rate in the market between 2025 and 2034. Diabetic retinopathy is the most frequent cause of new cases of blindness among adults aged 20 to 74 years in developed countries. Diabetes is highly prevalent health condition in the aging population. Over 29% of people over the age of 65 years have diabetes.

Additionally, aging populations, particularly in developed countries, contribute to a larger pool of elderly patients requiring regular eye care and treatment. Increased healthcare access, routine screening under geriatric care programs, and higher rates of comorbidities like hypertension further drive demand for diabetes.

Management Type Insights

What Made the Anti-VEGF Lead the Diabetic Retinopathy Market?

The anti-VEGF segment led the market. Anti-VEGF treatment improves vision in about 1 out of 3 people who take it. For vast majority 9 out of 10, it at least stabilizes vision. Anti-VEGF medicine blocks VEGF, slowing the growth of blood vessels in the eye. This slows or stops damage from the abnormal blood vessels and slows down vision loss. Anti-VEGF treatments are very successful and give a good chance of preventing further sight loss. The aim of treatment is to stabilize vision and prevent it from getting worse.

The vitrectomy segment is set to experience the fastest rate of the market growth from 2025 to 2034. Vitrectomy surgery helps to treat retinal problems. Vitrectomy is a surgical procedure undertaken by a specialist where the vitreous humor gel that fills the eye cavity is removed to provide better access to the retina. This allows for a variety of repairs, including the removal of scar tissue, laser repair of retinal detachment, and treatment of macular holes.

Distribution Channel Insights

How Hospitals and Pharmacies Dominates the Diabetic Retinopathy Market in 2024?

The hospitals and pharmacies segment dominates the market in 2024. Pharmacists provide essential information and healthcare services to patients who may need help in addition to that provided their doctor. As a qualified pharmacist they manage and monitor plans for patients to help prevent any medication errors or adverse reactions. Hospital pharmacists are involved in more detailed clinical-decision making, including medication therapy management and patient monitoring. They also offer specialized treatments like laser therapy and intravitreal injections, often unavailable in smaller clinics. Pharmacies, on the other hand, serve as critical access points for anti-VEGF drugs, corticosteroids, and other medications used in managing the condition.

The ambulatory surgical centers segment in anticipated to grow with the highest CAGR in the market during the studied years. Ambulatory surgical centers are reshaping healthcare by offering patients a faster, safer, and more affordable alternative to hospitals delivering same day surgeries with high quality outcomes and personalized care. Ambulatory surgical centers specialize in outpatient surgery and deliver personal care that is cost-effective, efficient, and convenient. As healthcare systems aim to reduce costs and improve service accessibility, especially for the growing diabetic population, ASCs offer a convenient alternative with lower overhead.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Top Companies in the Diabetic Retinopathy Market

-

Genentech, Inc.: Develops and commercializes anti-vascular endothelial growth factor (VEGF) treatments, such as Lucentis and Susvimo, which are delivered via eye injection or implant to inhibit vessel growth and leakage in diabetic retinopathy.

-

Kowa Company Ltd.: Focuses on supplying diagnostic products and pharmaceuticals for lifestyle-related diseases, including diabetic eye disease, but specific branded treatments for diabetic retinopathy were not identified.

-

BCNPeptides: Develops and conducts clinical trials for peptide-based, non-invasive eye drop treatments, such as RETISOM, for the prevention and management of moderate to severe diabetic retinopathy.

-

Ampio Pharmaceuticals Inc.: Developed Optina, an oral drug based on danazol, for diabetic macular edema (DME), a complication of diabetic retinopathy, though its efficacy is uncertain after trials were discontinued years ago.

-

Alimera Sciences: Offers Iluvien, a sustained-release intravitreal steroid implant that delivers fluocinolone acetonide for up to three years to treat chronic diabetic macular edema.

-

Sirnaomics: Researches and develops small interfering RNA (siRNA) therapeutics that target specific genes to potentially treat diabetic retinopathy and other ocular diseases.

-

Oxurion NV: Had a pipeline of therapeutic candidates, including plasma kallikrein and integrin antagonists, for diabetic retinopathy before filing for bankruptcy protection in 2023.

-

Novartis AG: Sells Beovu, an injectable anti-VEGF treatment approved in Europe for visual impairment due to diabetic macular edema, and has commercial rights to Lucentis outside the U.S.

-

ABBVIE INC.: Offers Ozurdex, a steroid implant for diabetic macular edema, and has a gene therapy research collaboration with REGENXBIO for diabetic retinopathy.

-

Bayer AG: Commercializes Eylea, an injectable anti-VEGF drug (developed by Regeneron), for treating diabetic retinopathy and diabetic macular edema by inhibiting blood vessel growth and leakage.

Recent Developments

- In April 2025, AI-based diabetic retinopathy screening software was launched by Dr. Mohan’s Diabetes Specialties. This initiative aims to harness the new artificial intelligence (AI) technology for early-stage diabetic retinopathy detection and apply this technology to offer quick and accurate analysis that will help doctors to make informed decisions. (Source: Dr. Mohan’s Diabetes Specialities Centre launches AI-driven diabetic retinopathy screening software)

- In February 2025, Nayanamritham 2.0, the World’s first AI-based Govt screening program for chronic eye disease was launched by the Government of Kerala in collaboration with Remidio. This pioneering initiative leverages artificial intelligence (AI) to improve early detection and efficient eye disease screening, making quality eye care more efficient and accessible across the state. (Source: Kerala launches world's first AI-driven Govt screening program for chronic eye diseases with Remidio)

By Type

- Proliferative Diabetic Retinopathy

- Non-Proliferative Diabetic Retinopathy

By Age Group

- 40-49

- 65-74

- 50-64

By Management Type

- Vitrectomy

- Anti-VEGF

- Intracular Steroid Injection

- Laser Surgery

By Distribution Channel

- Hospitals and Pharmacies

- Ambulatory Surgical Centers (ASCs)

- Eye Clinics

By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3954

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Diabetic Kidney Disease Market: Explore how innovation in therapeutics is reshaping chronic disease management

➡️ Ophthalmology PACS Market: See how digital imaging and cloud storage are transforming eye care diagnostics

➡️ Smart Retinal Implants Market: Discover breakthroughs enhancing vision restoration through neurotechnology

➡️ Diabetic Neuropathy Market: Analyze evolving treatment approaches addressing nerve damage in diabetic patients

➡️ Advanced Ophthalmology Technology Market: Track how AI, robotics, and precision tools are redefining eye surgery and care

➡️ Ophthalmic Devices Market: Understand global demand shifts driven by innovation in vision correction and diagnostics

➡️ Retinal Vein Occlusion Market: Gain insight into the expanding pipeline of biologics and anti-VEGF therapies

➡️ Ophthalmoscopes Market: Examine how portable and digital devices are improving early eye disease detection

➡️ Diabetic Footwear Market: See how smart materials and comfort design trends are driving diabetic care innovation

➡️ Ophthalmic Drugs Market: Explore how novel formulations and delivery systems are shaping the future of eye therapeutics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.