Pressure Sensitive Labels Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

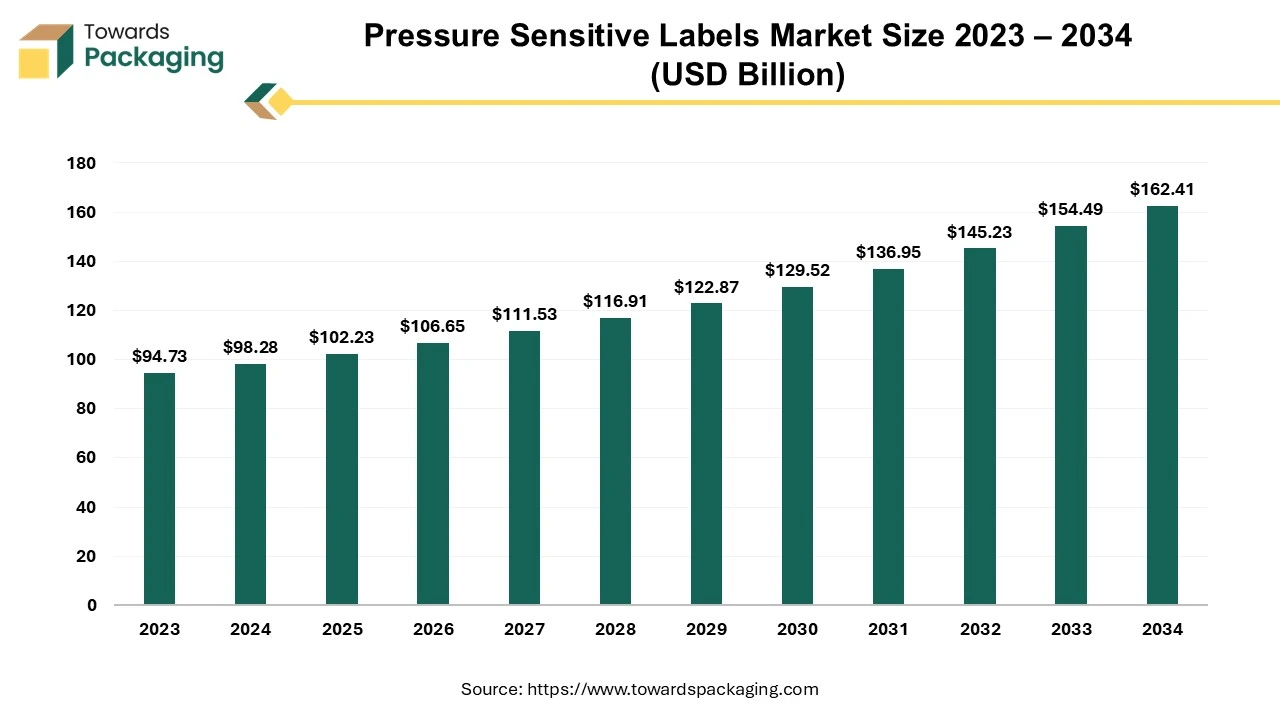

According to Towards Packaging consultants, the global pressure sensitive labels market is projected to reach approximately USD 162.41 billion by 2034, increasing from USD 102.23 billion in 2025, at a CAGR of 5.15% during the forecast period 2025 to 2034.

Ottawa, Oct. 30, 2025 (GLOBE NEWSWIRE) -- The global pressure sensitive labels market generated revenue of USD 102.23 billion in 2025, and this figure is projected to grow to USD 162.41 billion in 2034, according to research conducted by Towards Packaging, a sister firm of Precedence Research. Driven by the rising demand for sustainable and versatile labeling solutions.

With applications across multiple industries such as food & beverages, pharmaceuticals, and consumer durables, the market is set to benefit from advancements in printing technologies, such as digital and flexography. Additionally, smart labeling technologies like RFID integration are expected to drive market growth, alongside increased demand for eco-friendly materials and the shift towards biodegradable adhesives.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Pressure Sensitive Labels?

Pressure-sensitive labels are primarily self-adhesive labels with a pre-applied adhesive that sticks to surfaces when moderate pressure is applied, eliminating the need for heat, water, or additional glue. Further, they consist of three layers: the adhesive, a release liner, and face material, and are utilized for everything from food and medicine to cosmetics and industrial products.

Major Government Initiatives in the Pressure Sensitive Labels Industry:

- Extended Producer Responsibility (EPR) regulations: Governments in many regions are implementing EPR policies that hold manufacturers accountable for the entire lifecycle of their products, including packaging and labels, incentivizing the use of recyclable or waste-reducing label materials.

- Harmonization of chemical labeling (GHS): Global initiatives like the United Nations' Globally Harmonized System (GHS) have led to standardized requirements for the classification and labeling of chemicals, increasing the demand for durable and compliant pressure-sensitive labels.

- Food and drug safety regulations: Agencies such as the Food Safety and Standards Authority of India (FSSAI) and the U.S. Food and Drug Administration (FDA) mandate strict labeling for food and pharmaceuticals, including tamper-evident features and serialization, requiring high-quality pressure-sensitive labels.

- Ecolabeling certification programs: Government-backed ecolabel schemes, like India's Ecomark Rules, promote sustainable consumption by providing certification for environmentally friendly products, which directly drives demand for eco-friendly pressure-sensitive labels.

-

Digital product passport initiatives: In the European Union and other jurisdictions, regulations are pushing for digital "passports" that store information about a product's lifecycle, often accessed via QR codes on labels, boosting the need for smart and integrated pressure-sensitive labeling.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5381

What are the Latest Trends in the Market?

- Development of Recyclable and Biodegradable Materials: Consumers are increasingly aware of environmental problems and are more likely to buy products with sustainable packaging. This involves labels that are either compostable, biodegradable, or can be recycled, and the product's packaging. Governments are incorporating stricter regulations to decrease plastic waste and encourage sustainability. For instance, some regulations require that all food packaging be recyclable, reusable, or compostable by a specific date, including the labels on the packaging.

- Growth of intelligent and smart labels: Advancements in technology have led to the integration of RFID, NFC, and QR codes into labels for enhanced functionality and efficiency. These smart labels enable real-time tracking, anti-counterfeiting measures, and interactive consumer experiences.

- Advancements in digital printing technology: Digital printing allows for greater customization, faster turnaround times, and cost-effective production for short-run jobs. This technology facilitates variable data printing, enabling personalized and decorative labels that help brands stand out.

- Increasing demand for aesthetic and decorative labels: As brand owners seek to differentiate their products, they are utilizing advanced printing techniques like screen printing, foil stamping, and embossing on pressure-sensitive labels. This creates eye-catching, premium packaging that appeals to consumers and reinforces brand identity.

-

Rise of linerless labels: These labels, which lack a release liner, are gaining popularity due to their environmental and cost-saving benefits. By eliminating waste and reducing material and transportation costs, linerless labels offer a more sustainable and efficient option for various applications.

Market Opportunity

Rapid Advancements in Technology

Labels embedded with radio-frequency identification (RFID) tags permit businesses to track inventory and also products in real-time, decreasing waste and enhancing logistics. In the food industry, for example, RFID-enabled sensors can tailor a product's temperature to guarantee the integrity of the cold chain. Digital printing eliminates the demand for expensive and time-consuming printing plates, making it mainly cost-effective for small-to-medium-sized businesses and also for printing short runs of seasonal or restricted-edition products.

Limitations & Challenges

Raw Material Cost Fluctuation

The main limitations and challenges in the market include volatile raw material expenses, high upfront machinery and operational costs, the environmental burden of waste generation, and the demand to meet complex and even evolving regulatory and compliance standards. Other challenges are guaranteeing consistent adhesive performance over diverse conditions and even managing waste from the release liner, which is a huge contributor to environmental issues and disposal costs.

More Insights of Towards Packaging:

- Automotive Labeling Market Innovation & Competitive Strategy

- Industrial Labels Market Analysis, Competitive Dynamics and Regional Insights (2025-2034)

- Labeling Machine Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Shrink and Stretch Sleeve Labels Market Size, Segments Data, Regional Insights, Competitive Landscape, and Manufacturers Overview

- Ethical Label Market Growth Trends, Consumer Behavior and Regional Insights

- Compostable Packaging Labels Market Consumer Insights & Growth Strategies

- Biotechnology Labels and Packaging Market Research, Consumer Behavior, Demand and Forecast

- Tamper Evident Labels Market Research, Consumer Behavior, Demand and Forecast

- Ampule Sticker Labelling Machine Market Size, Demand, and Trends Analysis 2034

- Hazardous Label Market Performance, Trends and Strategic Recommendations

- Cryogenic Labels Market Outlook Scenario Planning & Strategic Insights for 2034

- Shipping Labels Market Research, Consumer Behavior, Demand and Forecast

- Smart Labels Market Size, Segments, Share and Companies

- Food Labels Market Emerging Trends, Investment Opportunities and Competitive Benchmarking

-

Wet Glue Labels Market Emerging Trends, Investment Opportunities and Competitive Benchmarking

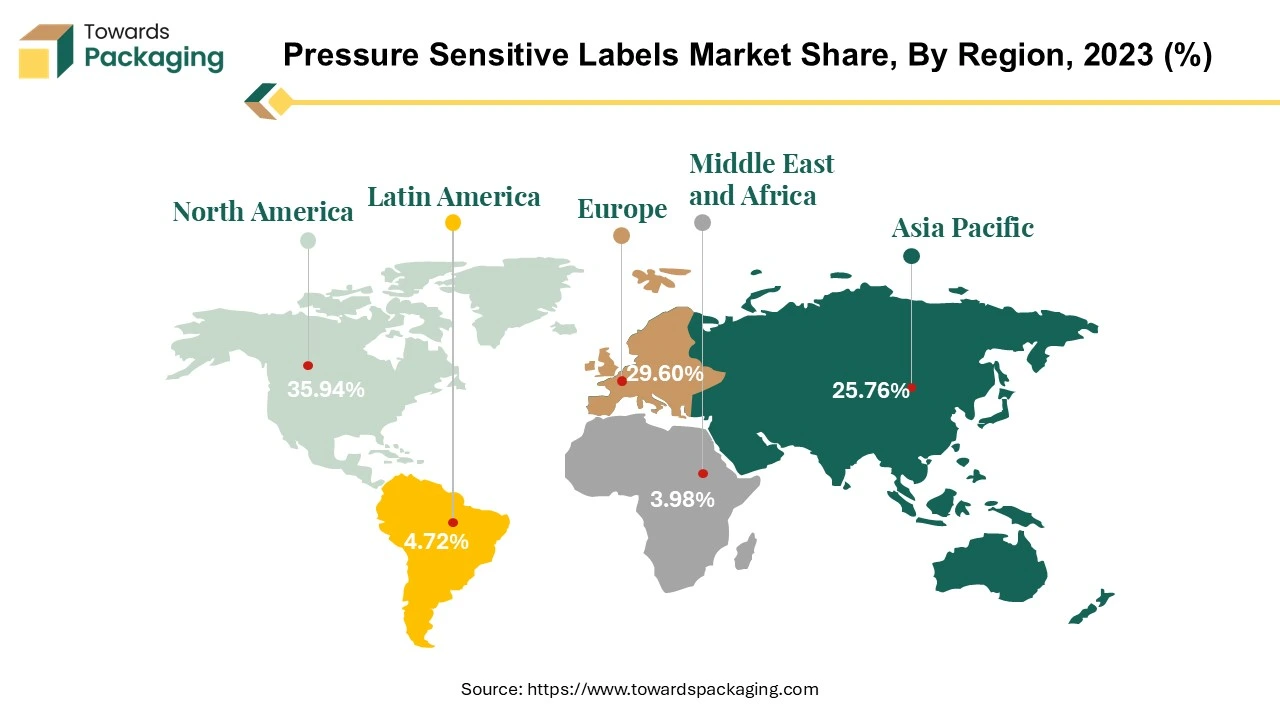

Regional Analysis

The Asian Adhesion: How APAC's Market Stranglehold Reshapes the Labels Industry

Asia Pacific leads the market because of rapid industrialization, economic expansion, and high consumer need, particularly in countries such as China and India. A rising number of industries, including manufacturing, electronics, automotive, and healthcare, are fueling the need for pressure-sensitive adhesives along with labels. The increased consumption of consumer goods, funded by changing lifestyles and a rising population, drives the need for efficient labeling.

China Pressure-Sensitive Labels Market Trends

China's market is experiencing significant growth, driven by the electronics, medical device, and automotive sectors, alongside strong e-commerce logistics and demand from the food and beverage industry. Key trends include a major focus on sustainability through recyclable materials and linerless labels, a rapid scale-up of digital printing to meet demands for customization, and the adoption of "smart labels" with QR/NFC for authentication and enhanced consumer experiences.

Japan Pressure-Sensitive Labels Market Trends

The market in Japan is driven by the need for high-tech, along with sustainable solutions in the food, electronics, and pharmaceutical sectors, with trends including product safety, technological integration, sustainability, and market restructuring. Japan's strong production base, stringent regulations, and focus on quality and innovation are major factors influencing these trends.

How is the Opportunistic Rise of North America in the Pressure Sensitive Labels Industry?

North America's market is demonstrating an opportunistic rise, driven by its large, developed consumer base, the explosive expansion of e-commerce, and the rapid move toward sustainable packaging. The growth of online retail and even shifting consumer purchasing habits has remarkably expanded the logistics and warehousing sectors, creating a huge need for pressure-sensitive labels for branding, shipping, and tracking. E-commerce companies need large volumes of durable and even weatherproof labels for shipping boxes and a rising number of smaller labels for individualized good packaging.

U.S. Pressure Sensitive Labels Market Trends

The U.S. overwhelmingly dominates the regional market, it accounts for the vast majority of regional production, demand and innovation, driven by its large food & beverage, pharmaceutical, consumer-goods and e-commerce sectors, heavy investment in label R&D and smart-label technologies, strict regulatory and traceability requirements that boost label usage, and the presence of major global suppliers and equipment makers (Avery Dennison, 3M, CCL, etc.) with extensive US operations. The distribution networks give the US scale advantages in production capacity, advanced labeling machinery adoption, and product development, solidifying the country's market position.

Segment Outlook

Material Insights

Which Materials Dominates the Pressure-Sensitive Labels Market?

The film/plastic segment dominates the market in 2024, with a share of 55.42%, due to its durability, versatility, and moisture resistance, which are vital for many industries such as packaging, food and beverage, and even automotive. Plastic films provide superior functionality, can withstand bad conditions better than paper, and also have high-quality printing capabilities, by making them ideal for premium and even long-lasting label applications. Plastic films offer excellent printability, permitting high-quality graphics and also a visually appealing finish that can improve brand image. This is a remarkable advantage for personal care, consumer goods, and pharmaceutical products.

The paper segment is the fastest-growing in the market during the forecast period. It is the most cost-effective as well as easy to print, making it a popular preference for a broad range of applications in industries such as food, beverage, and retail. While film labels are rising due to their durability and even premium look, paper's lower price point, flexibility, and even high-quality print capabilities manage its strong market supremacy and growth momentum. The need for sustainable solutions is also driving the advancement of new types of labels, including biodegradable films as well as linerless options. However, paper's cost-effectiveness may continue to make it the dominant material.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Adhesive Technology Insights

What Made the Water-based Technology Dominate the Pressure-Sensitive Labels Market?

The water-based segment dominates the market in 2024, due to its cost-effectiveness, eco-friendly nature, and versatility. These adhesives are primarily made without harmful volatile organic compounds (VOCs), which aligns with stricter environmental regulations as well as consumer need for sustainable packaging. Their affordability and ability to achieve numerous performance properties, such as adhesion and tackiness, also make them a popular alternative for a broad range of applications, from general-purpose labels to those present in the food and pharmaceutical industries.

The hot-melt-based segment is the fastest-growing in the market during the forecast period, due to its eco-friendly, suitability for high-speed manufacturing, solvent-free nature, as well as strong adhesion properties. These labels provide a faster application process with minimal waste and even strong initial tack, which makes them capable for the booming e-commerce along packaging industries. Their durability also makes them limited to heat and moisture, making them a preferred option for a broad range of products, which includes those in the food, healthcare, and even automotive sectors.

Printing Technology Insights

Why Flexography Segment Dominates the Pressure-Sensitive Labels Market in 2024?

The flexography segment dominates the market in 2024, due to its cost-effectiveness for mostly high-volume runs, versatility across numerous substrates (like paper, plastic, and foil), and also its ability to manufacture high-quality, durable labels suitable for competitive markets. Thus, this combination makes it ideal for manufacturing the large quantities of eye-catching and robust labels required for consumer goods.

The screen-printing segment is the fastest-growing in the market during the forecast period, due to rising needs from sectors such as pharmaceuticals, food and beverage, and e-commerce logistics, which need product identification, labels for branding, and information dissemination. Moreover, there is also an increased focus on sustainability, contributing to the adoption of eco-friendly materials as well as solutions such as linerless labels. It is more cost-effective for short runs, permits faster production, and allows greater customization to meet diverse consumer choices.

End-User Industry Insights

Which End-user Industry Dominates the Pressure-Sensitive Labels Market?

The food & beverages segment dominates the market in 2024, due to its large scale, the vital requirement for regulatory and even product data on packaging, the growing demand for consumer-facing branding, and even the versatility and durability of these labels for a wide range of products. This segment needs labels for everything from nutritional data as well as expiration dates to barcodes and also marketing, making pressure-sensitive labels an indispensable tool.

Recent Breakthroughs in the Global Pressure-Sensitive Labels Industry

- In April 2025, UPM Adhesive Materials began investing in a novel filmic coating line for its Johor Bahru, Malaysia factory. The installation is scheduled to improve the capabilities, efficiency, and production capacity of the factory, with the new line expected to be operational by mid-2026.

- In May 2025, CCL Industries Inc. declared that the Company intends to file with the Toronto Stock Exchange, as practicable, a notice of intention to renew its normal course issuer bid to buy its Class B non-voting shares.

Top Companies in the Pressure Sensitive Labels Market & Their Offerings:

- Avery Dennison Corporation: A global leader in materials science, Avery Dennison offers an extensive range of pressure-sensitive labels, including sustainable solutions like recycled-content and linerless labels.

- CCL Industries Inc.: One of the largest label producers, CCL Industries provides a broad portfolio of pressure-sensitive labels with advanced security, RFID, and decorative features for diverse industries.

- UPM Raflatac: This company is known for its focus on sustainable and eco-friendly pressure-sensitive labeling materials, offering recyclable and bio-based options.

- 3M Company: Leveraging its expertise in adhesive technology, 3M delivers high-performance pressure-sensitive labels for industrial, automotive, healthcare, and consumer goods.

- LINTEC Corporation: LINTEC manufactures a variety of adhesive products, including pressure-sensitive labels for industrial applications and various markets.

- Herma GmbH: As a European specialist, Herma produces a wide range of pressure-sensitive labels with innovative, solvent-free adhesives and a focus on industrial and special applications.

- Mondi Group: Mondi manufactures and supplies release liners and label films for the pressure-sensitive adhesives industry, with an emphasis on sustainability and specific label applications.

- Fuji Seal International, Inc.: Fuji Seal provides a variety of pressure-sensitive labels, including promotional, decorative, resealable, and heat-activated types, alongside their machinery.

- Multi-Color Corporation: This company provides high-quality printed pressure-sensitive labels, emphasizing premium decorative and brand presentation for consumer products.

- Coveris Holdings S.A.: Coveris offers a variety of self-adhesive label solutions, including multi-page booklets, decorative labels, and sustainable options like wash-off and linerless formats.

- Constantia Flexibles: Specializing in flexible packaging, Constantia Flexibles offers various pressure-sensitive label products, including resealable solutions and labels designed for recyclability.

- WS Packaging Group, Inc.: Known for a wide array of packaging products, WS Packaging Group offers custom pressure-sensitive labels, extended content labels, and promotional materials.

- Skanem Group: Skanem specializes in self-adhesive labels and shrink sleeves, providing solutions for retail, food and beverage, and pharmaceutical industries.

- Bemis Company, Inc.: Bemis, now part of Amcor, offers a comprehensive range of custom-printed pressure-sensitive labels for various products and markets.

Segment Covered in the Report

By Material

- Paper

- Film/Plastic

- Others

Adhesive Technology

- Water-Based

- Solvent-Based

- Hot-melt-Based

- Radiation-Based

By Printing Technology

- Flexography

- Lithography

- Letterpress

- Screen Printing

- Gravure

- Others

By End-User Industry

- Food & Beverages

- Pharmaceuticals

- Consumer Durables

- Home & Personal Care

- Retail Labels

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5381

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Flexible Paper Packaging Market Size Drives at 4.58% CAGR

- Digital Textile Printing Market Research, Consumer Behavior, Demand and Forecast

- Plastic Jar Packaging Market Size, Regional Data, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Corrugated Open-head Drums Market Size, Regional Data (NA/EU/APAC/LA/MEA), Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Box and Carton Overwrap Films Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Dental Retainer Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Contract Packaging Market Competitive Strategies, Growth Opportunities and Industry Innovations

- Paper Bag Packaging Market Size, Trends, and Forecast Analysis (2025-2034): Regional Insights, Market Segments, and Competitive Dynamics

- Flexible Green Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA) and Companies

- Europe Fresh Food Packaging Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA)

- Plant-Based Plastics Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Agricultural Films Market Size, Segments, Share and Companies

- U.S. Rigid Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Zero Waste Packaging Market Driven by 9.65% CAGR

-

Kraft Paper Bag Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.